33+ mortgage as percentage of income

Fast Approval Low APR Rates No Hidden Fees Reliable Reviews Online Comparison. Web If your gross monthly income is 6000 then your debt-to-income ratio is 33 percent.

What Percentage Of Income Should Go To A Mortgage Bankrate

Thats up from 24 in December and the highest.

. Web The Bottom Line. Total of 360 Mortgage Payments. The Rule of 28 otherwise known as the percentage of income rule advises not spending more than 28 of your gross monthly income on your.

Web The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on your mortgage payment including. Compare More Than Just Rates. On a 400000 property a 20.

Web If youd put 10 down on a 555555 home your mortgage would be about 500000. Find A Lender That Offers Great Service. Keep your mortgage payment at 28 of your gross monthly income or lower.

Web Rule Of 28. Ad It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan. In that case NerdWallet recommends an annual pretax income of at least 184656.

Web To determine how much income should be put toward a monthly mortgage payment there are several rules and formulas you can use but the most popular is the. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Choose The Loan That Suits You.

For example if your monthly income is 5000 you can. The maximum loan amount one can borrow normally correlates. Web The total of your monthly debt payments divided by your gross monthly income which is shown as a percentage.

Web Ideally home buyers should put at least 20 percent down on their new dwelling but thats simply not possible for many buyers. Ad Low Interest Online Lenders Comparison Reviews Top Brands Free Online Offer. Get All The Info You Need To Choose a Mortgage Loan.

Web A mortgage payment now costs 31 of the typical American household income according to Black Knight. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance. Web To follow this rule your monthly mortgage payment should be 28 or less of your gross monthly income.

Keep your total monthly debts including your mortgage. 10 12 22 24 32 35 and 37. Which of these brackets.

Your DTI is one way lenders measure your ability to manage. 2000 is 33 of 6000 If you use a calculator youll need to multiply the. Web There are seven federal income tax brackets for the 2022 tax year taxes filed in 2023.

What Percentage Of Your Income To Spend On A Mortgage

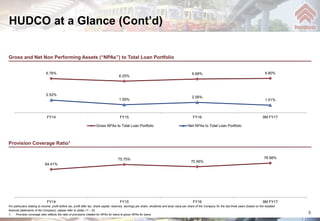

Presentation 03 2017

How Much Of Your Income Should Be Spent On A Mortgage Budgeting Money The Nest

What Percentage Of Income Should Go To Mortgage

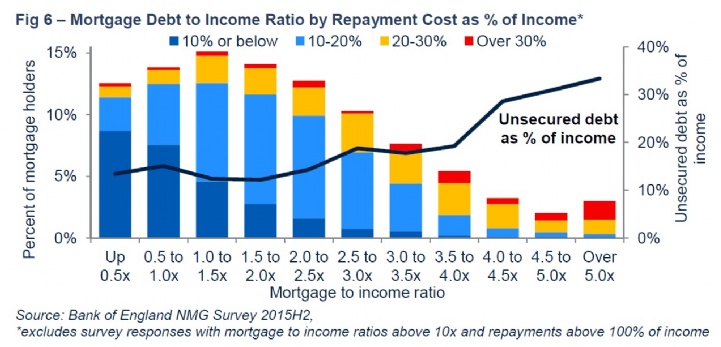

Savills Uk Household Debt

Hard Money Page 15 Sun Pacific Mortgage Real Estate Hard Money Loans In California

Stewart Madden Stewartmadden Twitter

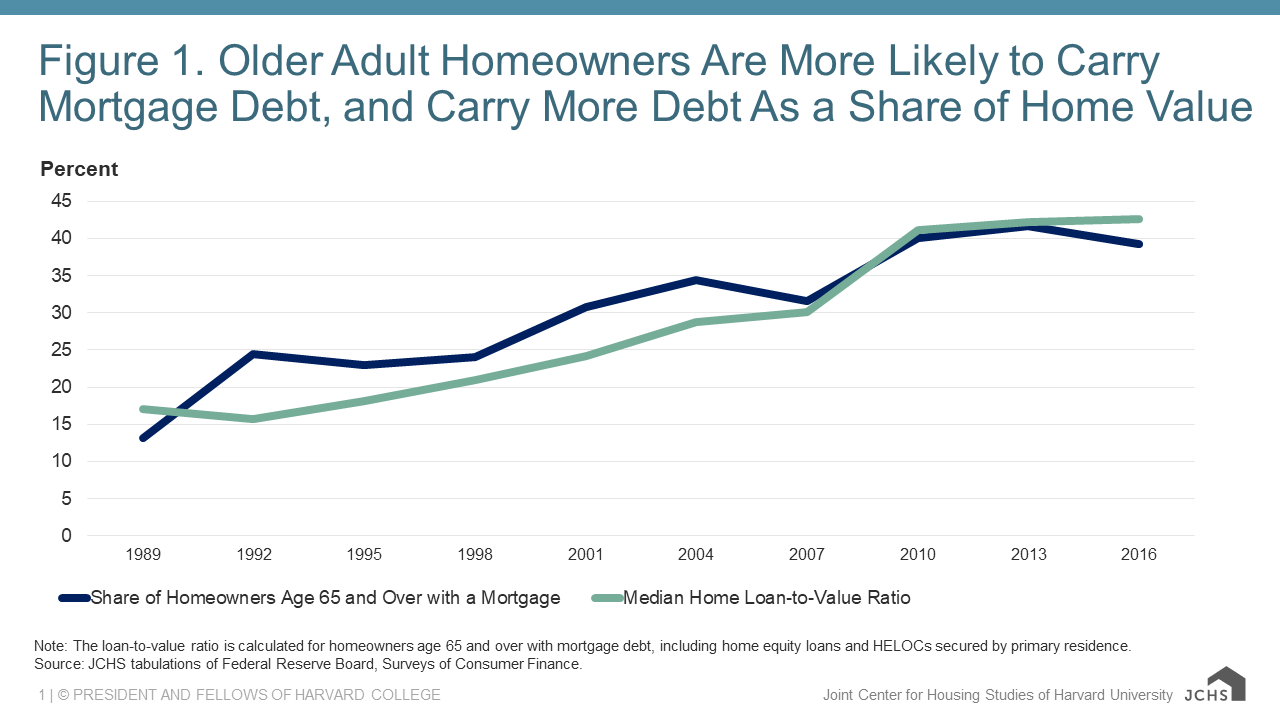

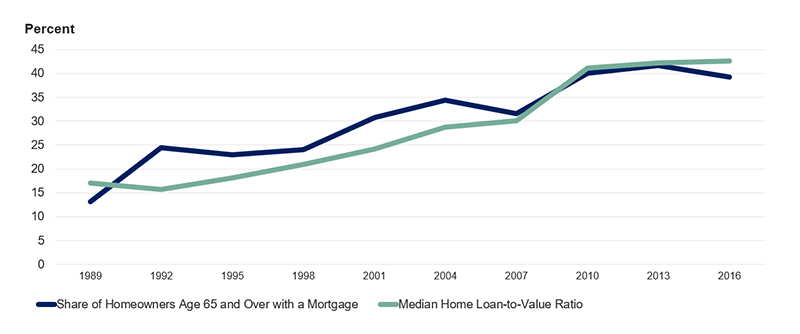

High Levels Of Mortgage Debt Are Associated With Lower Financial Well Being Among Older Homeowners Joint Center For Housing Studies

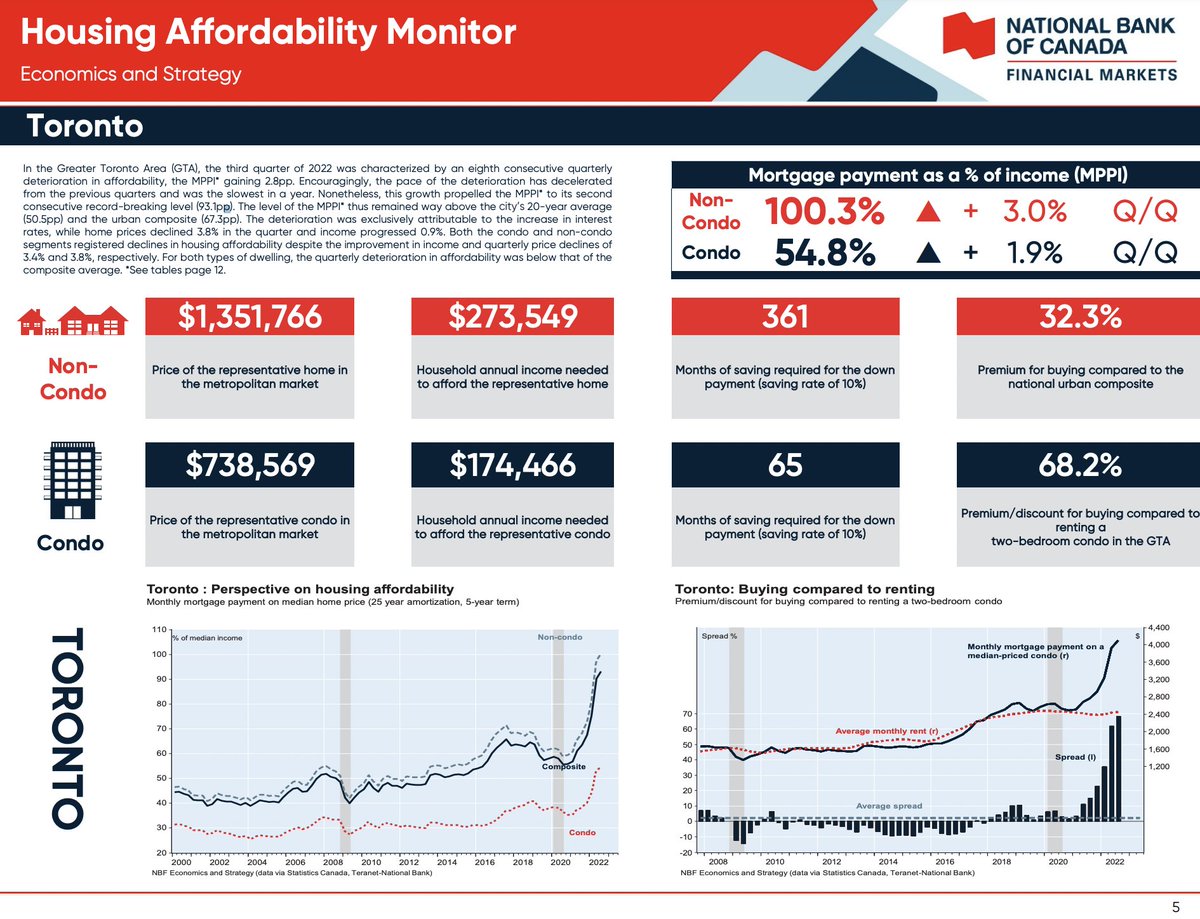

Understanding Housing Affordability Openforum Openforum

What Percentage Of Income Should Go To Mortgage

How Much Mortgage Can I Get For My Salary Martin Co

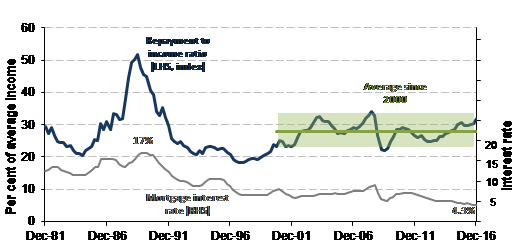

Impact Of Higher Mortgage Payments On Housing Affordability

High Levels Of Mortgage Debt Are Associated With Lower Financial Well Being Among Older Homeowners Joint Center For Housing Studies

Mortgage Repayments As A Percentage Of Income Download Scientific Diagram

Home Mortgage Debt To Disposable Personal Income Ratio In The Us Download Scientific Diagram

What Percentage Of Income Should Go To Mortgage

Pdf Alternative Forms Of Mortgage Finance What Can We Learn From Other Countries 1